michigan gas tax increase 2021

Federal Motor Fuel Taxes. Michigan will have the fifth highest at-pump.

Mackinac Center Policy Forum Virtual Event.

. Some state and local officials are now using potential revenue losses from the COVID-19 crisis as a reason to raise taxes. 0183 per gallon. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

The Gas Tax by state ranges from 00895 in Alaska to 0586 in Pennsylvania. Steven Johnson R on November 30 2021 To repeal an annual state gas and diesel tax increase based on the inflation rate for the past year which was imposed with a general increase in these taxes in 2015. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

Pennsylvania 0586 California 0533 Washington 0519952 New Jersey 0414 New York 04045 The average gas tax by state is 02885 per gallon. And the states gas tax as a share of the total. Most jet fuel that is used in commercial transportation is 044gallon.

Map shows gas tax increases in effect as of March 1 2021. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St.

2480 cents per gallon -327 less than national average 2021 diesel tax. If by the end of September the annual inflation rate ends up similar to that of the previous six years the. On January 1 2022 Michigan drivers started paying a tax of a little more than 27 cents.

The size of the january 2022 fuel tax increase will depend on how much the consumer price index has risen between oct. Gasoline 263 per gallon. 4198 cents per gallon 140 greater than national average 2021 diesel tax.

These rates vary widely from state to state and can be seen in the map below. It will have a 53 increase due to a rounding provision specified in the calculations. California pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg.

The FAQs on this page are effective January 1 2022. Diesel Fuel 263 per gallon. Since 2013 33 states and the District of Columbia have enacted legislation to increase gas taxes.

Michigan attorney general intervenes in DTE rate increase lowers. The five states with the highest gas taxes are. 1 the increase went into effect.

The average residential customer will see an increase of 318 per month when new gas rates go into effect January 1 2022. How much tax is on a gallon of gas in Michigan. The bill in Virginia raised the gas tax by 10 cents.

Under the governors proposal a 45-cent increase would occur in three. Michigans excise tax on gasoline is ranked 17 out of the 50 states. Michigan Governor Gretchen Whitmer D this week released her fiscal year FY 2020 budget bill central to which is a 45-cent gas tax increase and a new entity-level tax on unincorporated businesses.

The Michigan Public Service Commission today approved an 84173000 rate increase for DTE Gas Co. Throw in the 184. Twenty-three states have gas taxes higher than average and 27.

When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US. Hawaii Illinois Indiana and Michigan apply their general sales taxes to gasoline and thus see ongoing changes in their overall gas tax rates based on changes. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as.

Brace yourselvesnatural gas prices are supposed to increase by an estimated third in the coming months and bring the total 2021 increase. Previously repeal annual gas tax COLA Introduced by Rep. Would provide in 2021 1 billion for state trunk lines and 641 million for.

BIG RAPIDS Michigan drivers may have noticed a price jump at the pump in the New Year thanks to an increase in the states tax on gas. Fuel Tax Legislation. FOR IMMEDIATE RELEASE Dec.

Michigan gas tax increase 2021 Monday March 14 2022 Edit. For fuel purchased January 1 2017 and through December 31 2021. 1 the increase went into effect raising the gas tax from 19 cents per gallon to 263 cents while diesel went from 15 cents to 263 cents.

Thus far in 2021 two statesColorado and Missouri have raised their state gas tax although technically it was a fee in Colorado. As of January of this year the average price of a gallon of gasoline in Michigan was 237. Alternative Fuel which includes LPG 263 per gallon.

Gas tax holiday until October 2022 as passed. The Salt Lake Tribune calculated that would amount to about. Utahs gasoline tax saw a small increase in 2021 by 3 cents for every 10 gallons.

4318 cents per gallon 141 greater than national average. U-20940The rates approved today include 38 million for an infrastructure surcharge previously. Federal excise tax rates on various motor fuel products are as follows.

Gretchen Whitmer proposed a large tax hike. Currently Michigans fuel excise tax is 263 cents per gallon cpg. A 45-cent tax increase per gallon of gas.

The current state gas tax is 263 cents per gallon. 36 states have raised or reformed gas taxes since 2010. Matt Helms 517-284-8300 Customer Assistance.

Liquefied Natural Gas LNG 0243 per gallon. In 2020 one stateVirginiaand DC. 7 questions about Gretchen Whitmers Michigan gas tax increase.

The current federal motor fuel tax rates are. The lowest state gas tax rates can be found in Alaska at 1498 cents per gallon followed by Missouri. 2021 House Bill 5570.

These interests to hike taxes meet a. Mar 25 2020. At the beginning of the last legislative term Gov.

10 states to have gone two decades or more without a gas tax increase.

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Michigan S May Tax Proposal Mackinac Center

Every American Stands To Lose Under Unprecedented Gas Tax Increase

Gov Gretchen Whitmer Signals Likely Veto On Michigan Gas Tax Holiday Bridge Michigan

Michigan Gas Prices Would Drop 50 Cents Under Senate Approved Summer Tax Cut Mlive Com

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Michigan Gas Prices Rose 42 Cents In One Week Hitting Highest Peak In Years Mlive Com

Michigan S Gas Tax How Much Is On A Gallon Of Gas

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Michigan Gas Tax Hike Coming In 2022

Michigan Republicans Announce Plan To Suspend State Gas Tax For Next 6 Months

Michigan Gas Prices Hit 2021 High Here S Where It S Most Expensive In The State

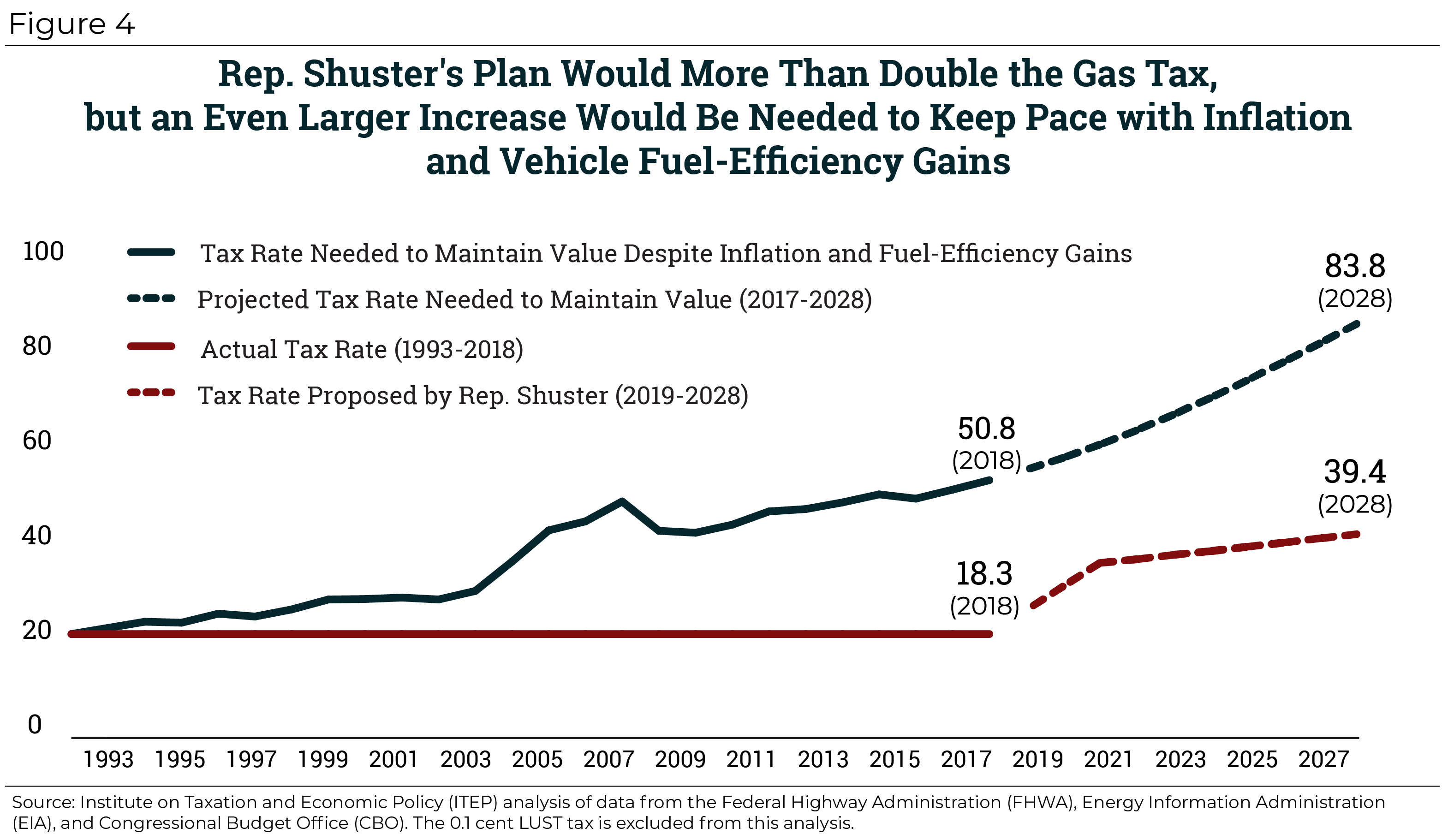

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Michigan S May Tax Proposal Mackinac Center

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates